This post was originally published here, as part of a series titled Demanding change by changing demand produced by environmental charity Global Action Plan. Some similar themes are explored in more technical detail in the context of lower- and middle- income countries in a recent working paper for the ILO, co-authored with Adam Aboobaker.

For much of the last thirty years or so, progressive economists have argued that macroeconomic policy is too tight. In simpler terms, this means that some combination of higher government spending, lower taxation, and lower interest rates will lead to more jobs and higher incomes.

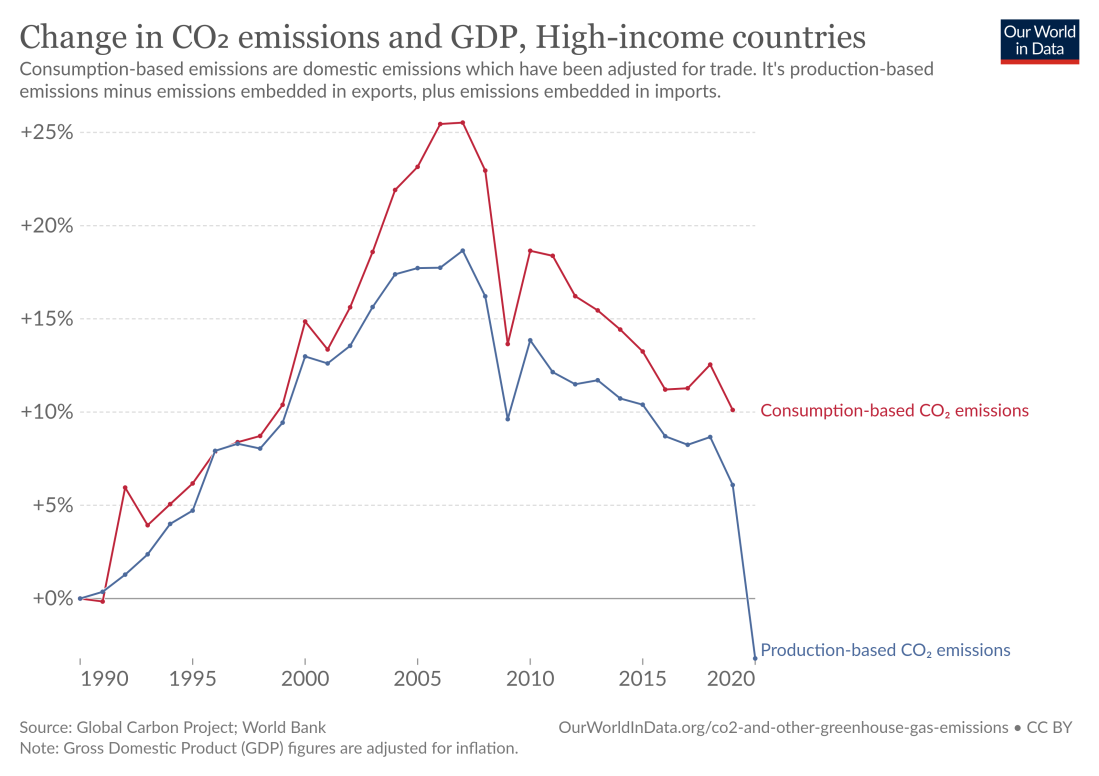

Such arguments are sometimes presented as part of advocacy for initiatives responding to the environmental crisis, such as the Green New Deal. For the most part, however, the environmental implications of higher near-term economic activity in rich countries do not attract much attention – it is taken as given that higher economic activity, as measured by gross domestic product (GDP), is unequivocally positive.

The current situation of high inflation, driven by energy shortages, war and climate change, serves as a sharp reminder that there is something missing in analysis which sees higher growth as an entirely free lunch. Almost all economic activity depletes scarce physical resources and generates carbon emissions. Higher employment usually comes at the cost of higher emissions. Furthermore, it is possible that we are now also reaching the end of the historic period in which physical resources were usually immediately available – so that economic activity could quickly rise in response to higher overall spending. The era of the Keynesian free lunch may be ending, replaced by a regime characterised by recurring inflationary episodes.

This puts progressive economists, like myself, who believe that the economies of rich countries are predominantly demand driven – meaning that higher overall spending means more jobs and higher incomes – in an uncomfortable position.

This view relies partly on the idea of the “multiplier”. This is the claim, which is well supported by empirical evidence, that every pound of new spending in the economy will generate additional income and spending over and above the initial pound spent. The mechanism works, to a large extent, by stimulating consumption spending: if a new government investment project is initiated – to provide additional green energy, for example – the money spent on the project – on wages, transport and materials – will be received by individuals and businesses as income. Some of this additional income will be spent on consumption, generating a second round of additional new incomes.

Similarly, the argument that redistribution from those on higher incomes to those on lower incomes is good for growth relies on the fact that those on lower incomes spend a greater proportion of their incomes on consumption goods – redistribution from rich to poor thus raises total consumption expenditure and economic activity.

How are progressive economists to respond to the now inescapable fact that current resource use greatly exceeds planetary limits, and “decoupling” – the trend for energy and resource use per dollar of spending to fall as GDP rises – will not be sufficient to stay within planetary boundaries if steady GDP growth continues?

There is no single answer to this question – the appropriate response will require action on many fronts simultaneously. However, economists are beginning to consider whether we need to introduce constraints on consumption, at least for those on higher incomes in rich countries, as part of the solution. Rather than relying only on voluntary consumer choice and natural shifts in consumption patterns – such as the trend towards lower consumption of meat in some rich countries – it may be that state intervention is required to influence both overall levels of consumption and its distribution.

There are two main arguments in favour of constraining consumption. The first is straightforward: all consumption, whether of food, transport, clothing or shelter, involves carbon emissions and resource depletion. Reduced consumption growth should translate directly into lower emissions growth.

The other relates to the need to reallocate current resources, including labour, towards the investment needed to fundamentally reshape our economic systems. Lower consumption means fewer people working in industries which provide for consumption spending, and fewer raw materials devoted to the production of consumption goods. This frees up resources for green investment: people and materials can be re-deployed towards the investment projects which are urgently needed.

This raises some thorny questions: what policy tools can be used to shift the composition and scale of consumption? Which groups should face incentives – or compulsion – to reduce consumption and what form should these measures take? How will voluntary shifts in consumption interact with more direct measures to reduce consumption? And crucially, how can jobs and incomes be protected without relying on consumption as a key driver of macroeconomic dynamism?

Much of this comes down to issues of distribution. Statistics on poverty make clear that large numbers of people in rich nations are unable to consume sufficient basic necessities. Basic justice dictates that the average incomes and consumption of those in lower income countries be allowed to catch up with those of richer countries. The need for redistribution of income within countries, and income catch-up across countries is undeniable – yet such redistribution, if it were to occur without other changes, will lead to increased overall consumption and emissions.

It is therefore hard to avoid the conclusion that taxation and regulation will be required to limit some part of the energy-intensive consumption of those on higher incomes in rich countries, particularly consumption which can be considered “luxury” consumption.

One plausible response to such suggestions is to claim that voluntary shifts in the kinds of things produced and consumed will naturally lead to reduced emissions, even while “consumption”, as measured by the national accounts, continues to grow. This kind of voluntary behavioural and consumption change – buying fewer cheap clothes, holidaying by rail rather than plane, switching to electric cars – will have a part to play in the transition to a low carbon economy, alongside reorientation from goods consumption to a more services-driven “foundational” economy. It is unlikely, however, that such changes will be sufficient.

The politics of consumption constraints are daunting. Managing competing distributional claims in the face of opposition from increasingly concentrated wealth and power is hard enough when the overall pie is growing. As we move towards a world of potential genuine scarcity, the politics of redistribution will become even more malign. This only emphasises the importance of getting the economics right.

Any successful response to the climate crisis will inevitably involve action and change at all levels – from local organising and “organic” shifts in consumption to reform of financial systems and action to tame corporate power and concentrated wealth. Constraints on the consumption of the relatively well off should be part of such a response. A debate about the economics and politics of these constraints is overdue.