Noah Smith has a Christmas post in which he intervenes in the debate over whether $600 government cheques should be given to rich people or poor people. This is the latest iteration of the age-old debate that stems from the dubious argument that income inequality is good because rich people use resources efficiently and poor people waste them. Noah correctly concludes that this argument is wrong and that cheques should be sent to those on lower incomes. But his argument contains several mistakes.

National Saving

Noah starts by discussing whether the rich or poor are more likely to save their $600 cheque, noting that although the rich have a higher propensity to save than the poor, the effect on “national saving” of windfall gains like a one-off cheque may be hard to predict: “if you want to increase national saving, you might want to give the $600 to Tiny Tim instead of to Scrooge!”

Noah’s assumption, at this point in the argument, is that unspent government cheques will increase “national saving”. Is this plausible?

The official definition of “national saving” is total income, Y, less total consumption expenditure, C, (including government consumption). Since “saving” for each sector is sector income less sector consumption, “national saving” is also equal to private saving plus public saving. Manipulation of accounting definitions demonstrates that S = I + CA, where S is national saving, I is total investment (private and public) and CA is the current account surplus. For a closed economy, CA = 0 and S = I. For “national saving” to increase, either I or CA must increase.

Why would members of the public — rich or poor — depositing government cheques at banks increase national saving?

If the cheques are bond-financed, then private sector financial investors have handed over deposits in return for government bonds, while households have accepted deposits. The overall effect is an increase in bond holdings by the private sector, and a redistribution of private deposit holdings. Since private sector income has increased but consumption has not, private sector saving has increased.

But public sector saving has decreased by an equal amount. National saving is unchanged — as is total income. (The same is true for tax-financed cheques.)

Loanable funds

Noah then poses the question “do we really want to increase national saving?”

On a charitable reading, we can assume that, by “national saving”, Noah means “private sector saving”, and his question should be read accordingly.

To answer the question, Noah uses the loanable funds model. Before going on, we need a brief recap on why this model is incoherent, at least when used without care.

As already noted, S = Y – C = I + CA: “National saving” is just another way of saying “investment plus the current account”. There is no such thing as a “supply of savings”: households can choose to consume or not consume. They cannot decide on the size of S, because it equals Y – C. Households choose C but not Y, therefore they don’t choose S. A macro model which has “supply of saving” as an independent aggregate variable is incorrectly specified.

Noah uses this model to consider what happens when the “supply of saving” increases (which he apparently takes as equivalent to the “supply of” what he calls national saving).

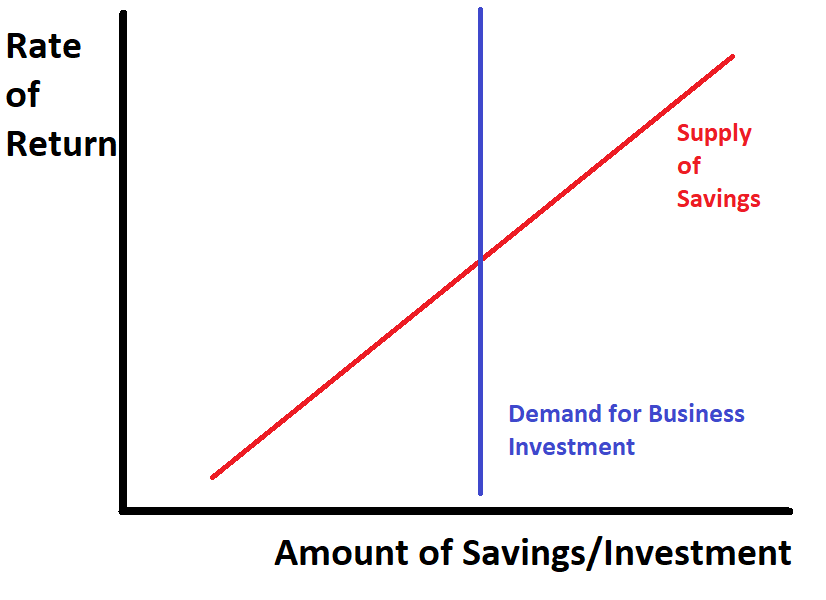

He starts by noting that the usual configuration is such that an increase in the “supply of saving” causes “interest rates or stock returns or whatever” to fall and this in turn raises business investment. He then adjusts the model by asserting, “OK, suppose that the amount of business investment just doesn’t depend much on the rate of return”. (By “rate of return” he means “interest rates or stock returns or whatever”, i.e. the rate paid on loans by business, not the rate of profit on business investment.) This gives a diagram like so:

Now, here comes the punchline:

OK, now suppose that in this sort of world, you give someone $600 and they stick it in the bank. That increases the supply of savings. But it doesn’t do anything to the demand for business investment. Businesses invest the same amount. And the rate of return just goes down … in fact total saving doesn’t even go up!

What’s going on here? The supply of savings has increased yet total saving doesn’t change? To understand what Noah thinks he’s saying, let’s switch to apples briefly. Imagine the same supply-demand diagram as above with a vertical (inelastic) demand curve but this time for apples.

This model says that, assuming the quantity of apples consumed is fixed, if the cost of production of apples decreases (because that’s what the supply curve represents, at least in a competitive market), then the price of apples falls. A similar outcome arises if, instead of the cost of production falling, a magician appears, waves a wand, and a stack of extra apples magically appear all harvested and ready for market. At the marketplace, if nobody knows about the wizard, it just looks like the price of apples has fallen.

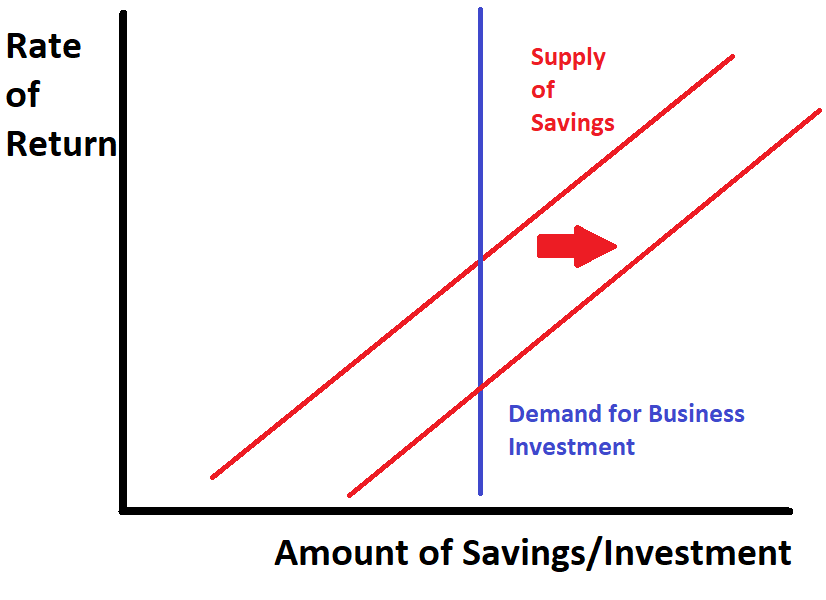

This is what Noah is doing with the “increase in supply of savings (apples)” arising from the $600 cheques (magic apples): since the “demand for savings” (apples) is fixed, apple sales (business investment/”national savings”) won’t change, but the price (“the rate of return on stocks or whatever”) falls. On the diagram, it looks like this:

This is incoherent in its own terms because, as already noted, a “supply of savings” doesn’t exist in the same way that a supply of apples does: apples are not one number minus another number.

But even putting this non-trivial issue aside, There is a another problem.

Where did the apples go?

Remember that the “supply of savings” has increased in the sense that the price per unit has fallen. But the actual quantity of “savings” is unchanged, according to Noah.

In apple world, the way this works is that when the magic apples appear, the orchard people, understanding the inelastic demand curve of the marketplace, save themselves some effort, harvest less apples, but take the right amount to the marketplace.

How does it work for the “supply of savings?” Don’t worry, Noah has an answer!

You give the $600 to one person, they stick it in the bank or in the markets, that lowers interest rates or stock returns or whatever, and then other people save $600 less as a result. No change.

Pretty neat. Every time someone banks a $600 cheque, another person responds by spending exactly $600 on consumption! In the aggregate, Noah tells us, every dollar is spent! It’s actually impossible for the private sector to save their cheques!

Conclusion

This kind of incoherence is where you end up when you read results from pairs of lines that do not represent the thing that you are trying to understand. The conclusion that total consumption expenditure increases by an amount exactly equal to the total value of the cheques arises as the result of a sequence of ill-defined concepts and inappropriate assumptions, all bolted together without much thought.

In reality, what will happen is the following. Some cheques will be saved, some will be spent on consumption. Those that are saved will have no effect on national saving and probably little effect on the rate of interest, although they might nudge asset prices up a bit. Higher consumption will lead to higher national income, employment and imports. National income will probably rise by more than the amount spent on consumption because of the multiplier. “National saving” is a residual — income less consumption — and is a priori indeterminate. None of this requires us to go anywhere near a loanable funds model.

Loose use of terminology and hand-waving at poorly-defined graphical models does not constitute macroeconomic analysis.

thanks. It has been a very interesting post. I only have one question. You approach the financing of checks through bonds and taxes, but not by simply issuing money. could you address this point? thank you and sorry for my english

LikeLiked by 1 person

Sure, and no problem.

If say $1m of cheques are financed through direct money issuance we could compare this to the bond issuance case as follows:

1) Bond issuance:

– Issue $1m bonds. $1m deposits (and reserves) are removed from private sector and $1m bonds added.

– Provide cheques using money issuance: $1m deposits are added to the private sector.

2) Direct money issuance.

– Skip the first step above and just do:

– Provide cheques using money issuance: $1m deposits are added to the private sector.

So in the bond issuance case, the net effect is no change in deposits, £1m extra bonds in private sector hands. In the monetary financing case, the net effect is no change in bonds, £1m extra bank deposits in private sector hands.

So the only difference is the financial instrument issued by the government to finance its deficit. The effect on sectoral saving is identical in the case of bond issuance or monetisation.

(Some would argue with my sequencing: for bond financing they would argue that money issuance comes first, the bonds ‘sterilise’. The end result is the same though.)

LikeLike

Excellent post.

Ramanan pointed me to your good twitter thread on this subject and so I came here.

Economics uses accounting in various types of observations – investment, saving, etc. – and so it needs top down consistency for the meaning of these things and how they relate to coherent macroeconomics. Most conventional economics is a failure in this regard. Keynes reflected this very well in the General Theory, IMO.

Several specific observations:

I think there is a sense in which the terminology “supply of saving” is potentially meaningful and useful. Investment plus the current account surplus could be viewed as creating a supply (flow) of national saving from the standpoint of coherent accounting logic. I think this is correct in the sense of the actual temporal order of causation between investment and saving, etc. I can understand why those who are aware of the typical misuse of the term “supply” in this context might shy away from using the same terminology in a different way, but I think it makes sense.

I find (Godley’s) sector financial balances useful as an analytical perspective, complementing standard balance sheet, income, and flow of funds accounting. I think the notion that a government deficit is a private sector surplus (closed economy simplicity) is a useful gateway for thinking about Keynesian ideas around fiscal and monetary policy.

To borrow your phrase, “this kind of incoherence” is where we’ve been, where we are, and where we’re going in so far as most economics is concerned – until the next Keynes comes along and writes down a Treatise of Economic Logic that emphasizes the fundamental relationship between economics and accounting. It’s much more than bookkeeping. But it takes imagination to see that. I haven’t seen the deep logic of it put front and center in thinking about economics (Godley and Lavoie come very close, but not close enough IMO). I don’t like to get overly optimistic, but maybe something definitive and revolutionary along these lines will happen around the 150th anniversary of The General Theory (yes I know when that is). That’s my estimate based on the current drag induced by great immoveable (academic) forces. Until then, most economists will quietly or loudly disparage the importance of it and continue on with the evolution of classical incoherence.

LikeLiked by 1 person

Thanks for the comment and checking out the blog! I can’t find anything to disagree with in your comment.

LikeLike

“In reality, what will happen is the following. Some cheques will be saved, some will be spent on consumption.”

Therefore, if I,G and X don’t change, national saving will decrease by the amount that imports increase as a consequence the higher C and Y.

If rich people have a lower mpc, their cheques will reduce national saving less than poor people’s

Yes, the LF funds model is incoherent, but we don’t need to agonize about what’s happening to deposits, bonds, the interest rate, etc., to get an answer to this question.

LikeLike

At the risk of repetition, some more thoughts:

Macroeconomics goes off the rails with diagrams of geometry that oversimplify. It is a bizarre teaching emphasis. It is not necessary. It distracts. It is a third order visualization device at best. Smith’s post is illustrative of how forcing macroeconomics into a logic that is derived from geometric modelling is suboptimal, and probably doomed to misfiring.

I think your post illustrates the notion that it is not possible to do coherent macroeconomics without coherent financial accounting and coherent national income accounting. Those who disagree with that would need to invent their own version of accounting in order to proceed with anything of substance. And in doing so they would quickly become ensnared by internal contradiction and logical failure.

Accounting is algebraic – not geometric. So it is with the accounting framework for macroeconomics.

Keynes’ General Theory is replete with this emphasis. And he was trained as a mathematician, so he understood the choice.

(He did use a few diagrams, I guess, but quite sparingly and not plastered indiscriminately throughout the book).

LikeLike

Examples regarding geometric distortion, as noted above:

a) Whether actual or desired, the notion of a diagrammatic intersection of investment and saving is redundant, if not incoherent. Macroeconomic investment always precedes, and results in, equivalent macroeconomic saving – logically and temporarily. The two are equivalent in quantity at all times (inventory investment included, of course).

On the other hand, a concept of equilibrium between investment and finance (i.e. the entire configuration of financial intermediation) does make sense, IMO. It is easy to imagine that financial intermediation is continuously working its way through dynamic adjustment toward some idea of “equilibrium”. That is what flow of funds accounting captures at time intervals. But this is certainly not the same thing as an equilibrium between investment and saving.

b) Similarly, the laying of an LM diagram component on top of an already redundant and/or incoherent IS equilibrium diagram concept is insult to injury. It is impossible for a central bank not to have some concept of setting and/or targeting some reference interest rate(s). How they do that is a matter of secondary monetary mechanics. They do “whatever it takes” in the circumstances, be it a tightly controlled commercial bank reserve setting in order to steer a reference rate indirectly, or by paying interest on QE type bank reserves. The notion of an LM curve in an ISLM frame is entirely unnecessary in this context.

LikeLike

Thanks for sharing! This was really insightful 🙂

LikeLiked by 1 person